Having a criminal charge or conviction in one’s background can make things more difficult for a licensed insurance producer. However, it doesn’t always have to mean the end of a career, as long as you follow your state’s procedures for reporting the new history. It’s best to start with your resident state, but don’t forget to notify all states where you hold a nonresident license as well.

To help you fulfill your reporting obligations, we’ve created this state-by-state guide to how each state handles an already-licensed producer who needs to report new criminal charges, convictions, military convictions, or adminstrative actions. For a bit more background on the laws surrounding certain types of felonies, and how the Producer Licensing Model Act (PLMA) tries to standardize procedures across states, see Part One of this five-part series, which also covers the first 10 states.

Jump to a state

With 50 states plus the District of Columbia to cover, we’ve divided this topic into a series. This article covers New Mexico through South Carolina, and you can click the state below to jump directly to it.

Alabama | Alaska | Arizona | Arkansas | California | Colorado | | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | Washington | Washington, D.C. | West Virginia | Wisconsin | Wyoming

How to renew my New Mexico insurance license after a criminal conviction

According to the New Mexico Office of the Superintendent of Insurance website, those with felonies, misdemeanors, or other criminal offenses on their record are looked at on a case-by-case basis when determining whether to grant or renew an insurance license. New Mexico says producers should provide the state with “a copy of the charging document(s) and a copy of the official document which demonstrates the resolution of the charge(s) or any final judgment”.

While the website doesn’t give any specific instructions for submitting those documents, licensed producers should follow the procedures laid out in the PLMA, which means to report within 30 days, and use the NIPR Attachments Warehouse – Reporting of Actions to submit documentation.

New Mexico does specify that it grants 1033 waivers, also known as a Letter of Written Consent for resident producers looking to continue holding an insurance license after being convicted of a felony involving dishonesty or breach of trust. The state provides this application for written consent and says to send your application to:

Office of the Superintendent of Insurance

1120 Paseo De Peralta

Santa Fe, NM 87501

What about misdemeanors in New Mexico?

New Mexico says that you don’t have to report:

- Misdemeanor traffic citations

- Misdemeanor convictions involving driving under the influence (DUI) or driving while intoxicated (DWI)

- Driving without a license

- Reckless driving

- Driving with a suspended or revoked license

- Misdemeanor offenses that were adjudicated in a juvenile court

Aside from these specifics, you should treat misdemeanors in New Mexico like any other criminal charges or convictions.

What about nonresident producers seeking to renew their New Mexico license after a conviction?

For nonresident producers who hold a New Mexico insurance license, submitting your documentation via the NIPR Attachments Warehouse – Reporting of Actions will alert the state of any criminal or administrative actions you’ve had taken against you in another state.

When it comes to those crimes involving dishonesty or breach of trust, for which a 1033 waiver is required, New Mexico says nonresident producers should provide a copy of their 1033 waiver from their resident state. This doesn’t guarantee that New Mexico will also grant written consent, but it’s required if you want to apply for it as a nonresident producer.

One final note on insurance licensing and criminal convictions in New Mexico

It’s not just individual producers who can get into hot water with criminal actions. The state of New Mexico warns:

Licensed business entities:

https://www.osi.state.nm.us/pages/bureaus/producers/license-information/criminal-offense&sa=D&source=docs&ust=1722621136666300&usg=AOvVaw3s40IW4SvPoSppmcvLD3OP

– It is a criminal offense to employ anyone (in any capacity) who requires – but does not provide – a Letter of Written Consent.

– You must make a diligent effort to identify those employees or prospective employees who require a Letter of Written Consent.

How to renew my New York insurance license after a criminal conviction

According to New York Consolidated Laws Chapter 28, Article 21, Section 2110, the superintendent may revoke or suspend an insurance producer, consultant, adjuster, or life settlement broker license for a number of reasons, including the license holder being convicted of a felony.

New York may also revoke or suspend a license if the producer (or adjuster, consultant, or life settlement broker) had their license suspended or revoked in another state, province, district, or territory.

To take it a step further, New York also has the right to revoke or suspend a license “for an action or conduct which, if it had been established upon a hearing before the superintendent, would have constituted grounds for revocation of a license under subsection (a) of this section”.

New York law states a licensee must report to the superintendent:

- Any administrative action taken against them in another jurisdiction or by another governmental agency within 30 days of the final disposition of the matter, and should include a copy of the order, consent to order, or other relevant legal documents.

- Any criminal prosecution taken in any jurisdiction, and should include a copy of the initial complaint filed, the order resulting from the hearing, and any other relevant legal documents.

What about misdemeanors in New York?

New York doesn’t differentiate between felonies and misdemeanors, so licensed producers should proceed to report all new criminal charges and convictions.

What about nonresident producers seeking to renew their New York license after a conviction?

New York’s law doesn’t make a distinction between resident and nonresident producers. Generally speaking, when a producer reports actions to their resident state (assuming they’re using the NIPR Attachments Warehouse – Reporting of Actions) their nonresident license states will also be notified. So, producers with a nonresident license in New York should use that method to ensure proper reporting.

How to renew my North Carolina insurance license after a criminal conviction

North Carolina General Statutes Section 58-33-46 state that “the Commissioner may place on probation, suspend, revoke, or refuse to renew any license issued under this Article” for reasons including conviction of a felony or misdemeanor for a crime involving dishonesty, breach of trust, or moral turpitude.

As for reporting these to the state, North Carolina General Statutes section 58-2-69(c) instructs licensees to report a conviction “in any court of competent jurisdiction for any crime or offense other than a motor vehicle infraction” within 10 days. North Carolina also clarifies that a “conviction” refers to “an adjudication of guilt, a plea of guilty, or a plea of nolo contendere.”

So, while it appears more likely that a license will be revoked for crimes involving dishonesty, North Carolina is very serious about licensed agents and adjusters reporting any convictions (other than motor vehicle infractions) – and much more quickly than other states!

What about misdemeanors in North Carolina?

North Carolina instructs licensees to report all convictions, other than motor vehicle infractions. This makes no distinction between felonies and misdemeanors. Additionally, North Carolina specifically says it may revoke a license for even a misdemeanor that involves dishonesty, breach of trust, or moral turpitude.

What about nonresident producers seeking to renew their North Carolina license after a conviction?

North Carolina makes no distinction between resident and nonresident producers.

How to renew my North Dakota insurance license after a criminal conviction

According to North Dakota Century Code Chapter 26.1-26:

https://ndlegis.gov/cencode/t26-1c26.pdf#nameddest=26p1-26-45p1

- An insurance producer shall report to the commissioner any administrative action taken against the insurance producer’s license in another jurisdiction or by another governmental agency in this state within thirty days of the final disposition of the matter. This report must include a copy of the order, consent to order, or other relevant legal documents.

- Within thirty days after a criminal conviction, an insurance producer shall report to the commissioner any criminal conviction of the insurance producer taken in any jurisdiction. The report must include a copy of the initial complaint, the order issued by the court, and any other relevant legal documents.

In addition, the commissioner may “suspend, revoke, place on probation, or refuse to continue or refuse to issue any license issued under this chapter” if:

“The applicant or licensee has been convicted of a felony or convicted of an offense, as defined by section 12.1-01-04, determined by the commissioner to have a direct bearing upon a person’s ability to serve the public as an insurance producer, insurance consultant, or surplus lines insurance producer, or the commissioner finds, after conviction of an offense, that the person is not sufficiently rehabilitated under section 12.1-33-02.1.”

https://ndlegis.gov/cencode/t26-1c26.pdf#nameddest=26p1-26-45p1

What about misdemeanors in North Dakota?

North Dakota law doesn’t specify any difference between felonies and misdemeanors. The language of “an offense” implies felonies or misdemeanors that the insurance commissioner determines impact a person’s suitability to act as a producer, insurance consultant, or surplus lines producer will result in a license revocation.

What about nonresident producers seeking to renew their North Dakota license after a conviction?

North Dakota law 26.1-26-42.1 states that nonresident licenses may be revoked or suspended if the resident license of the nonresident North Dakota producer has been revoked or suspended by their resident state. Presumably, nonresident producers should follow their resident state’s procedures, most likely uploading their documentation to the NIPR Attachments Warehouse – Reporting of Actions, where it will be accessible to their resident state and any other states where they hold nonresident licenses.

How to renew my Ohio insurance license after a criminal conviction

Let’s start by noting that Ohio’s laws are quite specific and thorough, more so than other states when it comes to the matter of licensed insurance producers (or those hoping to be) and their criminal backgrounds.

First and foremost, Ohio’s department of insurance is “prohibited from refusing to issue a license to an individual based solely on being charged with or convicted of a criminal offense or based on a nonspecific qualification such as ‘moral turpitude’ or lack of ‘moral character’.” That’s great news for Ohio producers and insurance license applicants with a criminal history.

With that said, there is a list of criminal offenses that Ohio says “may disqualify” a new applicant from getting their initial license. On the other hand, these offenses aren’t an automatic disqualification and the state takes many factors into consideration.

TL;DR: If you’re a licensed insurance producer in Ohio and you have a criminal charge or conviction, work closely with the state DOI to determine how it will impact your license (or not!).

Ohio Revised Code Section 3905.14 says that the superintendent of insurance may “suspend, revoke, or refuse to issue or renew any license of an insurance agent, assess a civil penalty, or impose any other sanction or sanctions authorized under this chapter, for one or more of the following reasons…”

Among these reasons are:

- Being convicted of, or pleading guilty or no contest to, a felony regardless of whether a judgment of conviction has been entered by the court;

- Being convicted of, or pleading guilty or no contest to, a misdemeanor that involves the misuse or theft of money or property belonging to another, fraud, forgery, dishonest acts, or breach of a fiduciary duty, that is based on any act or omission relating to the business of insurance, securities, or financial services, or that involves moral turpitude regardless of whether a judgment has been entered by the court;

Ohio has some additional unique provisions within its insurance laws.

According to Ohio Revised Code Section 9.78:

“An individual who has been convicted of any criminal offense may request, at any time, that a licensing authority determine whether the individual’s criminal conviction disqualifies the individual from obtaining a license issued or conferred by the licensing authority. An individual making such a request shall include details of the individual’s criminal conviction and any payment required by the licensing authority. A licensing authority may charge a fee of not more than twenty-five dollars for each request made under this section, to reimburse the costs it incurs in making the determination.

“Not later than thirty days after receiving a request under this section, the licensing authority shall inform the individual whether, based on the criminal record information submitted, the individual is disqualified from receiving or holding the license about which the individual inquired. A licensing authority is not bound by a determination made under this section, if, on further investigation, the licensing authority determines that the individual’s criminal convictions differ from the information presented in the determination request.”

https://codes.ohio.gov/ohio-revised-code/section-9.78&sa=D&source=docs&ust=1722621136666721&usg=AOvVaw1d6xmm33eeRSf-zIn8UMPA

As for reporting a criminal conviction to the Ohio Department of Insurance, producers and applicants in this situation need to provide:

- A personal statement

- Police report(s)

- Charging court documentation

- Conviction/sentencing court documentation

- Probation termination/parole termination

Ohio requests this information be submitted via the NIPR Attachments Warehouse – Reporting of Actions.

What about misdemeanors in Ohio?

According to email correspondence with the Ohio Department of Insurance, Ohio requires producers and applicants to report any criminal offenses, both felony and misdemeanor, unless it’s a traffic violation. However, it appears that the law doesn’t automatically penalize producers who report misdemeanors. Only when those misdemeanors involve “the misuse or theft of money or property belonging to another, fraud, forgery, dishonest acts, or breach of a fiduciary duty, that is based on any act or omission relating to the business of insurance, securities, or financial services, or that involves moral turpitude” are they specifically called out as a grounds for losing a license.

What about nonresident producers seeking to renew their Ohio license after a conviction?

There is no difference in procedures or requirements for nonresident licensed producers when it comes to criminal offenses and/or administrative actions. Ohio looks at all actions individually and on a case-by-case basis.

How to renew my Oklahoma insurance license after a criminal conviction

Oklahoma Title 36, Section 1435.13 states that “The Insurance Commissioner may place on probation, censure, suspend, revoke or refuse to issue or renew a license…” for reasons including “having been convicted of a felony” and “having an insurance producer license, or its equivalent, denied, suspended, censured, placed on probation or revoked in any other state, province, district or territory,” among a list of other reasons.

For licensed producers, applicants, or those seeking renewal who find themselves in this position, Oklahoma Statutes Title 36, Section 1435.18 requires you to report to the insurance commissioner:

- Within 30 days of the final disposition of the matter: any administrative action taken against that person in another jurisdiction or by another governmental agency in this state, which must include a copy of the order, consent to order or other relevant legal documents.

- Within 30 days of the initial pretrial hearing date: any criminal prosecution of that person taken in any jurisdiction, which must include a copy of the initial complaint filed, the order resulting from the hearing and any other relevant legal documents.

Oklahoma’s law goes on further to say that “failure to comply with this statute shall result in immediate suspension of an application for, a license of or renewal of a producer license.”

Additionally, in email correspondence from the Oklahoma Department of Insurance, we learned that every charge requires the original charging documents certified by the court, a detailed letter of explanation from the licensee and (eventually) the final disposition documents certified by the court.

All of the above must be submitted via the NIPR Attachments Warehouse – Reporting of Actions in order to be considered “reported” to the state of Oklahoma.

Finally, Oklahoma provides resident insurance producers the opportunity to apply for a 1033 waiver to sell insurance if they’ve previously been convicted of a crime involving moral turpitude. For nonresident producers with an Oklahoma license, they must first receive a 1033 waiver from their resident state prior to applying for (or renewing) a nonresident Oklahoma license.

What about misdemeanors in Oklahoma?

Oklahoma’s law makes no distinction between felonies and misdemeanors, although being convicted of a misdemeanor isn’t on the list of items a producer may lose their license for. In terms of reporting requirements, it appears the state does require all criminal charges and convictions to be reported. It just may be that reporting a misdemeanor is less likely to result in a license revocation, suspension, or nonrenewal.

What about nonresident producers seeking to renew their Oklahoma license after a conviction?

Oklahoma’s laws do not specify any difference in the procedures for reporting criminal charges or convictions for nonresident licensees. Only when referring to crimes that require a 1033 waiver does Oklahoma specify that a producer has to obtain one from their resident state first before applying for the same consent to sell insurance in Oklahoma.

How to renew my Oregon insurance license after a criminal conviction

According to Oregon Revised Statute ORS 744.074 the Director of the Department of Consumer and Business Services may suspend or revoke a license for a number of reasons, including “Having been convicted of a felony, of a misdemeanor involving dishonesty or breach of trust, or of an offense punishable by death or imprisonment under the laws of the United States.”

If a producer becomes aware that they’re being charged with any felony, or a misdemeanor that involves fraud, dishonesty, or breach of trust, Oregon requires them to notify the Director of the Department of Consumer and Business Services no later than 30 days after receiving notice of the charges.

Oregon states that license applicants and producers with new criminal charges and convictions while already licensed are required to submit the following pieces of information.

- A letter of explanation detailing the circumstances/narrative of the crime(s)

- A copy of the charging document from the court for each case

- A document from the court of jurisdiction showing completion of the case. Completion means the case is closed and any assessed punishment fully completed. This means any fines/fees assessed paid in full.

- If the case is old enough that documents no longer exist with the court of jurisdiction, then a document from the court stating that to be the case will satisfy the document requirement

The applicant is also required to submit any additional documentation that the Oregon Division of Financial Regulation may request in conjunction with a background review, either via the NIPR Attachments Warehouse – Reporting of Actions, or by mail.

On top of that, Oregon may suspend, revoke, or nonrenew a license if the same has been done by any other U.S. state, Mexico, or Canada. Taking it even a step further, Oregon may impose these types of penalties if “the authority to practice law or to practice under any other regulatory authority” has been taken away for reasons related to dishonesty, fraud, or deception. Simply put, if you’ve lost a different type of license or been disbarred, your Oregon insurance license may be at risk as well.

Does Oregon grant 1033 waivers for insurance producers

Yes, Oregon does grant 1033 consent waivers to allow insurance producers to continue working in the business of insurance after they’ve been convicted of a crime involving dishonesty, breach of trust, or moral turpitude. However, according to email correspondence with the state’s licensing and compliance department, Oregon’s process differs from most other states. That’s why we’re recapping it here.

Oregon requires an affidavit from an executive of the insurance company the applicant will be representing that indicates that the company is aware of the applicant’s history, that the applicant will only perform the insurance activities described in the application, that the application is true and correct, and that the applicant won’t be placed in a position where their activities would constitute a threat to consumers or the insurer. This affidavit must come from an insurance company executive with fiduciary responsibility to the insurer.

Because Oregon’s process is so different from other states, it requires nonresident licensees facing these specific types of convictions, or applicants with a history of them, to complete its process regardless of whether the applicant’s resident state granted them a 1033 waiver.

What about misdemeanors in Oregon?

Oregon law specifically names misdemeanors related to dishonesty, breach of trust, or “an offense punishable by death or imprisonment under the laws of the United States” as grounds for losing a license.

According to email correspondence from the Oregon Division of Financial Regulation (DFR), the exceptions to the reporting requirements are listed on the Uniform Licensing Application, and only apply to misdemeanors. For example, the DFR clarifies, while reporting a misdemeanor conviction for driving under the influence of intoxicants (DUII) wouldn’t be required, reporting a felony DUII would be.

As for any misdemeanors not specifically listed as exceptions on the application, Oregon requires producers and applicants to report them even if they ultimately won’t disqualify a producer or applicant from engaging in the business of insurance.

What about nonresident producers seeking to renew their Oregon license after a conviction?

Oregon performs its own determination of a producer’s fitness to engage in the business of insurance, whether as a resident licensee or nonresident producer.

One final note on insurance licensing and criminal convictions in Oregon

Like many other states, business entities can also lose their insurance licenses if the director of insurance determines that: “an individual licensee’s violation was known or should have been known by one or more of the partners, officers or managers acting on behalf of the partnership or corporation but the violation was not reported to the director and corrective action was not taken.”

So, for insurance leadership, the onus is on you to pay attention to your producers’ behavior.

How to renew my Pennsylvania insurance license after a criminal conviction

According to Pennsylvania Code Title 31, Chapter 37, Section 37.48:

An agent or broker who has been denied a certificate or license or has had an existing certificate or license revoked, suspended or nonrenewed under § 37.46(5) (relating to standards for denial of certificate/license); or who has pleaded guilty or nolo contendere or has been found guilty of criminal conduct (emphasis added) as set forth in § 37.46(7)(i), shall report this fact to the Department in writing within 10 business days after the occurrence of the event. An insurance entity having knowledge of the occurrence of the event concerning its agents or concerning brokers with whom it deals shall similarly make this fact known to the Department in writing within 10 business days after learning of the event.

https://www.pacodeandbulletin.gov/Display/pacode?file=/secure/pacode/data/031/chapter37/chap37toc.html&d=reduce

Note, the law’s 10 business day reporting time frame, compared with most states’ 30-day requirement.

A point of clarification according to email correspondence from the Pennsylvania Insurance Department, “resident and nonresident producers are required to report new charges, convictions, and administrative actions, etc. within 30 days.”

This obviously differs from what’s written in the law, so we caution producers in this situation to err on the side of caution and alert the state within 10 days, and/or contact Pennsylvania directly for direction on your specific situation.

The law also specifies that the department of insurance may deny an applicant a license (or revoke, suspend, or nonrenew a license) if the applicant or producer has, within five years prior to applying for a license, “pleaded guilty, entered a plea of nolo contendere or has been found guilty of a felony in a court of competent jurisdiction, or has pleaded guilty, entered a plea of nolo contendere, or been found guilty of criminal conduct which relates to the applicant’s suitability to engage in the business of insurance, shall be evidence of lack of fitness for a certificate or license.”

The law clarifies even further:

“Examples of criminal violations which the Department may consider related to the applicant’s suitability to engage in the business of insurance are unlawful advertising of insurance business, unlawful coercion in contracting insurance, furnishing free insurance as an inducement for purchases, unlawful collection practices, embezzlement, obtaining money under false pretenses, conspiracy to defraud, bribery or corrupt influence, perjury or false swearing, unlicensed activity or a criminal offense involving moral turpitude or harm to another.

“Examples of violations or incidents which the Department will not consider related to the applicant’s suitability to engage in the business of insurance are all summary offenses, records of arrest if there is no conviction of a crime based on the arrest, convictions which have been annulled or expunged or convictions for which the applicant has received a pardon from the Governor.”

https://www.pacodeandbulletin.gov/Display/pacode?file=/secure/pacode/data/031/chapter37/chap37toc.html&d=reduce

To fulfill these reporting requirements, the Pennsylvania Insurance Department says: “Resident and nonresident producers may report new charges, convictions, administrative actions, etc. by submitting a Reporting of Action notification via the NIPR Attachments Warehouse. Pennsylvania must be selected as a state to receive the notification in order for us to review the uploaded information and consider it a timely reporting. Alternatively, they may notify the Department in writing via mail or by email to RA-IN-ROA@pa.gov”.

In terms of the specifics that need to be submitted, Pennsylvania states:

For criminal matters, producers should provide certified copies of their court documentation when available. Below is a list of what is typically requested:

- Criminal Complaint, including Affidavit of Probable Cause

- Information, Indictment, or other charging documents

- Sentencing Documentation

- Court Docket

- Proof of satisfaction of Judgment including paid fines, restitution

- Proof of completion of probation or parole; or if still under supervision, a status letter from the probation/parole office that includes the anticipated completion date

- A written statement detailing the event(s) that led to each arrest

For administrative actions, producers should provide:

- A written statement identifying the type of license and explaining the circumstances of each incident

- A copy of the Notice of Hearing or other document that states the charges and allegations

- A copy of the official document, which demonstrates the resolution of the charges or any final judgment

The Department also says that producers may need to disclose new actions at the time of their license renewal and should review the license renewal background questions carefully to ensure they provide correct answers. Producers who provide an incorrect answer to a background question on a license application, including renewal applications, will be asked to provide a written statement indicating why they did not answer the background question affirmatively.

Preliminary licensing determinations and 1033 consent waivers in Pennsylvania

The state provides two specific resources that current and prospective producers may find helpful:

- Preliminary licensing determination: A new applicant may, before completing their Pennsylvania insurance license application, complete a prelicensing determination to get a good sense of whether or not their background information would exclude them from getting a license.

- 1033 consent waiver: For resident and nonresident producers seeking a Pennsylvania insurance license, and who have a specific type of criminal conviction in their background, the state offers the chance to apply for a 1033 consent waiver to get permission to engage in the business of insurance.

On the second point, email correspondence from the Pennsylvania Insurance Department explains that nonresident producers must first obtain a 1033 consent waiver from their resident state (when needed) and Pennsylvania will review it and make a case-by-case determination on whether to accept the consent waiver and/or grant the nonresident insurance license.

What about misdemeanors in Pennsylvania?

According to email correspondence with the Pennsylvania Insurance Department:

Producer reporting requirements for felonies and misdemeanors are the same. New charges that do not need to be reported include misdemeanor DUI, misdemeanor and summary traffic offenses, and non-traffic summary offenses.

What about nonresident producers seeking to renew their Pennsylvania license after a conviction?

According to email correspondence with the Pennsylvania Insurance Department:

The Department considers both resident and nonresident producers’ backgrounds on a case by case basis. Consideration is given to determinations made by a producer’s resident state, but it does not guarantee continued reciprocity.

How to renew my Rhode Island insurance license after a criminal conviction

According to Rhode Island’s Producer Licensing Act (Section 27-2.4-14), the insurance commissioner “may place on probation, suspend, revoke or refuse to issue or renew an insurance producer’s license or may levy an administrative penalty” for reasons including being convicted of a felony and “having an insurance producer license, or its equivalent, denied, suspended or revoked in any other state, province, district or territory or administrative action under this section.”

So, if that’s the case for you, section 27-2.4-18 of the law states that

You must report to the insurance commissioner:

- Any administrative action taken in another jurisdiction or by another governmental agency in this state within 30 days of the final disposition of the matter, including a copy of the order, consent to order, or other relevant legal documents.

- Any criminal prosecution taken in any jurisdiction – within 30 days of the initial pre-hearing date – including a copy of the initial complaint filed, the order resulting from the hearing, and any other relevant legal documents.

While the law doesn’t specify how to submit these documents, we recommend using the NIPR Attachments Warehouse – Reporting of Actions, which will notify your resident state and all other states where you hold insurance licenses.

What about misdemeanors in Rhode Island?

Rhode Island doesn’t differentiate between felonies and misdemeanors, so licensed producers should proceed to report all new criminal charges and convictions.

What about nonresident producers seeking to renew their Rhode Island license after a conviction?

Rhode Island’s law doesn’t make a distinction between resident and nonresident producers. Generally speaking, when a producer reports actions to their resident state (assuming they’re using the NIPR Attachments Warehouse – Reporting of Actions) their nonresident license states will also be notified. So, producers with a nonresident license in Rhode Island should use that method to ensure proper reporting.

How to renew my South Carolina insurance license after a criminal conviction

According to South Carolina Title 38, Section 38-43-130, the Director of the Department of Insurance may “place on probation, revoke, or suspend a producer’s license after ten days’ notice or refuse to issue or reissue a license when it appears that a producer has been convicted of a crime involving moral turpitude, has violated this title or any regulation promulgated by the department, or has wilfully deceived or dealt unjustly with the citizens of this State.”

In addition to crimes of moral turpitude, the same consequences may apply to any licensed producer who has been convicted of a felony, convicted of a misdemeanor “involving dishonesty, breach of trust, or other financial- or insurance-related crime” and other no-nos.

South Carolina notes: “For purposes of this section, ‘convicted’ includes a plea of guilty or a plea of nolo contendere, and the record of conviction, or a copy of it, certified by the clerk of court or by the judge in whose court the conviction occurred is conclusive evidence of the conviction.”

In this situation, South Carolina law requires:

(A) A producer shall report to the director or his designee any administrative action taken against the producer in another jurisdiction or by another governmental agency in this State within thirty days of the final disposition of the matter. This report shall include a copy of the order, consent to order, or other relevant legal documents.

(B) Within thirty days of a conviction, a producer shall report to the insurance director any criminal conviction of the producer taken in any jurisdiction. The report must include a copy of the order, sentencing document, or plea agreement and any other relevant legal documents.

https://www.scstatehouse.gov/code/t38c043.php

What about misdemeanors in South Carolina?

South Carolina specifies that a producer may lose their license after being convicted of a misdemeanor “involving dishonesty, breach of trust, or other financial- or insurance-related crime,” but it makes no mentions of other misdemeanors. The language of the law, requiring a producer to report “any criminal conviction,” implies that producers must report misdemeanors, although you may be less likely to face license revocation if the misdemeanor doesn’t relate to dishonesty or breach of trust.

What about nonresident producers seeking to renew their South Carolina license after a conviction?

The text of South Carolina’s insurance code doesn’t differentiate between resident and nonresident producers. It would be wise for nonresident producers with a South Carolina insurance license to use the NIPR Attachments Warehouse – Reporting of Actions to submit documentation that will then be distributed to any state in which they hold a nonresident license as well.

What to do if you have new criminal charges or convictions

As we’ve made our way through the first 40 states on our list, one thing’s become clear. Every state requires insurance producers to report new criminal activity to the insurance commissioner or department of insurance, and to do so within 30 days – or 10 days if you’re in Pennsylvania or North Carolina. Beyond that, the specifics vary.

Whether there are exceptions to the types of crimes that need to be reported, whether a producer needs to report charges or only convictions, and what the chances are that you can keep an active license after reporting any type of criminal conviction are among the variables that each state determines for itself.

We hope this guide has been helpful, but the bottom line is that if you’re an insurance producer facing criminal charges or convictions, your best bet will be to consult with your attorney and your state’s DOI directly to make sure you fulfill any requirements. Doing nothing is guaranteed to land you in more trouble than following the state’s reporting requirements.

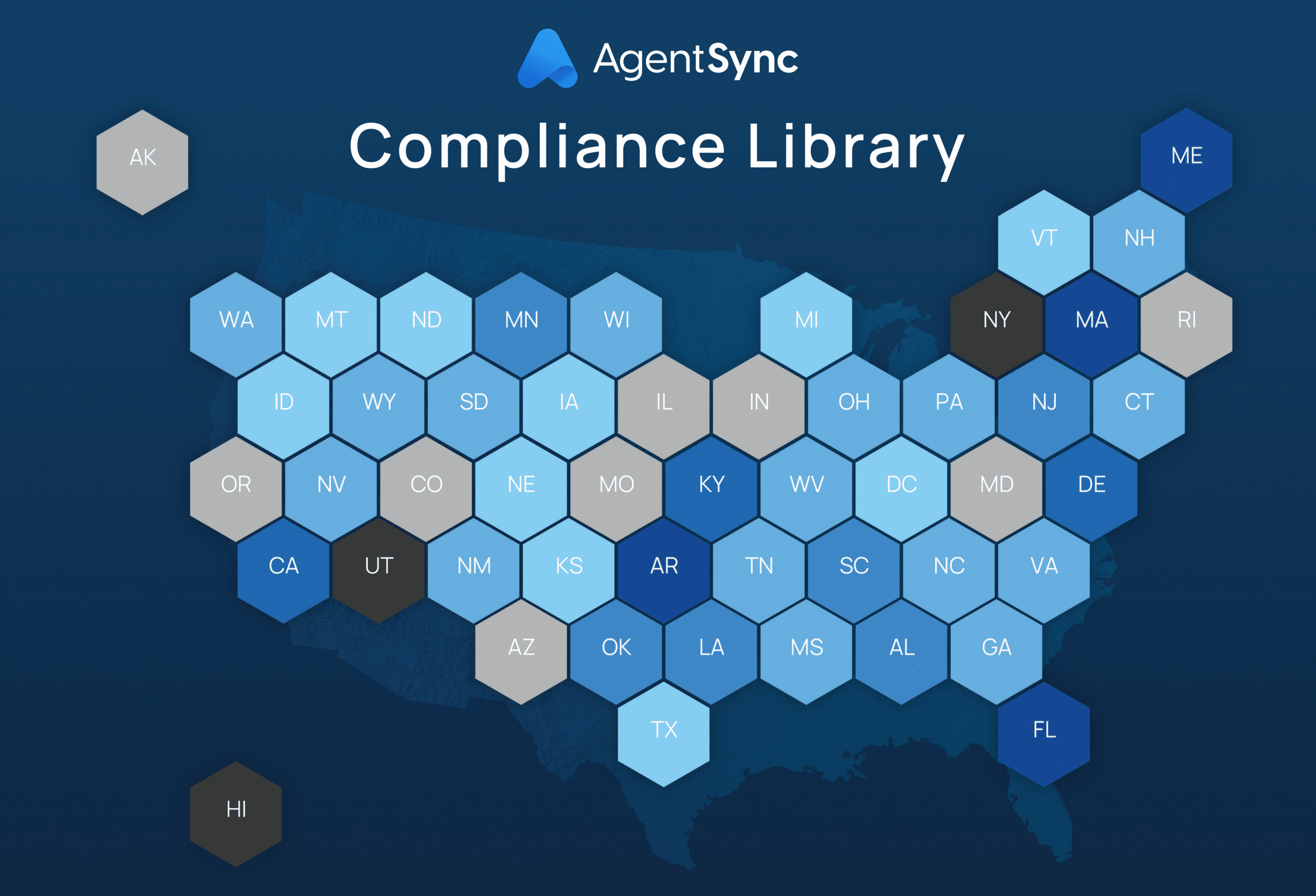

To learn more about the nuances of state-by-state insurance compliance, check out our free Compliance Library where we’ve done the research for you. If you’re ready to make compliance streamlined and automatic at your insurance agency, carrier, MGA, or MGU, see how AgentSync can help.