Compliance Library ©

Insurance is mostly regulated on a state-by-state basis, with each state and U.S. territory determining their own legal standards and procedures. Here you can find state-specific information such as department of insurance contacts; read FAQs about licensing, carrier appointments, and Just-In-Time requirements; and stay up to date with relevant articles and blogs.

Comparison Table

With AgentSync’s 50 State Summary Table, we’ve taken the top questions concerning licensing, appointments, adjuster, and business entity management and set them in a comparative grid across the states and territories. Have an at-a-glance understanding of how each state handles appointments or licensing.

Get access to the 50 State Summary Table

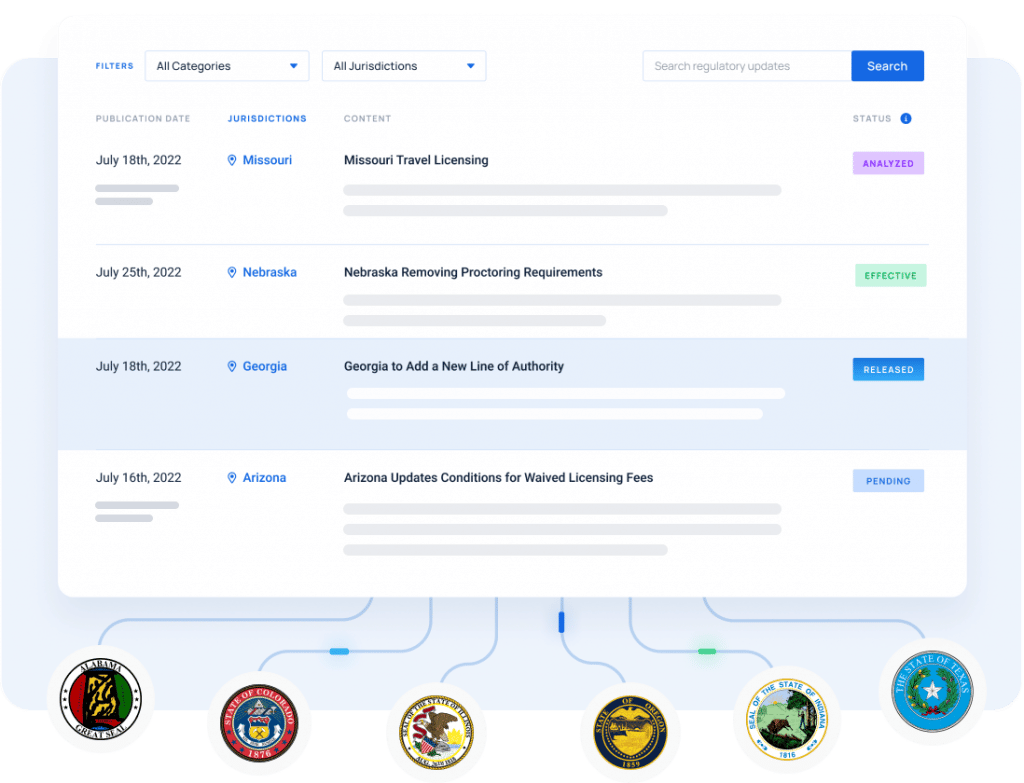

Make Sure You Don't Miss a Regulatory Update

For more on regulatory evolution and emerging market trends, subscribe to the AgentSync thought-leadership newsletter

Upcoming Changes

New Jersey Company Issue Date Display

Effective March 12, 2026, New Jersey will start displaying the Company and Line of Business Issue dates on the Producer Database.

District of Columbia 2026 Company Appointment Renewals

Effective March 4, 2026, District of Columbia company appointment renewal invoices will be available for payment from March 4, 2026, through May 31, 2026. The termination deadline is February 24, 2026. The cost is $25 per appointment per company.

Ohio TPA Expiration Fee Updates

Effective March 12, 2026, Ohio will update the TPA late fee for applicants. For every month past the expiration date, the cost will be $25 cheaper.

California Reminder 2025 Annual Tax Returns Due

Posted January 15, 2026, the Surplus Line Association of California posted a reminder that 2025 annual tax returns are due on or before March 2, 2026. Please see the attachment for more information.